Top 5 Reasons Choice Protect360 is Perfect for First-Time Insurance Buyers

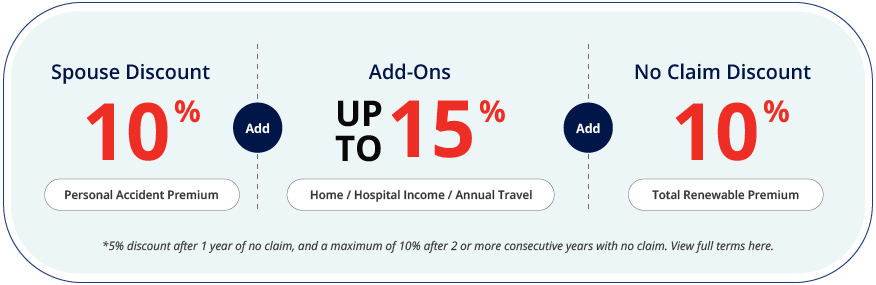

When you’re buying insurance for the first time, it can feel overwhelming. From understanding what different policies cover to figuring out which one suits your lifestyle, the journey can be confusing. That’s where HL Assurance’s Choice Protect360 comes in. Designed specifically for beginners in mind, this flexible insurance plan offers a comprehensive, all-in-one insurance solution…

Details