Q: Can I purchase more than one Fraud Protect360 Plus plan?

A: Yes, you can purchase up to two (2) Fraud Protect360 Plus plans; either Silver and Gold or Silver and Platinum plans.

Q: Who is covered under Fraud Protect360 Plus?

A: You as an individual or You and your spouse as described in the policy schedule. The policy does not extend to other family members.

Q: Who is eligible to be insured under Fraud Protect360 Plus?

A: You must be between the ages of eighteen (18) to sixty-five (65) years old. You must also be a Singapore Citizen, Singapore Permanent Resident, or a foreigner holding a valid pass issued by the Singapore government and residing in Singapore.

Q: What is covered under Fraud Protect360 Plus?

A: It covers Online Shopping Fraud, Fund Transfer Fraud, Cyber Extortion, Restoration Costs and Identity Theft. It also covers Personal Accident benefits such as Accidental Death and Permanent Total Disablement, Accidental Medical Reimbursement, Hospital Cash Benefit, Hospital Cash Benefit – ICU and Emergency Medical Transportation.

Q: What is not covered under Fraud Protect360 Plus?

A: Refer to the below key exclusions:

- Love or Confidence Scam, or Face to face ransom

- Online Gambling and Online Auction

- Corporate or Business Cyber Liability, Cyber Operation

- Digital Currency

- Maintenance Costs

- Legal Proceedings (without HLAS consent)

- Reimbursable Fraud Loss (Any financial loss that is reimbursable by Your Personal Account, Payment Card company, bank or other financial institution.)

Exclusions of Fraud Protect360 Plus, please refer to section “Exclusions Applicable To Cyber” on page 6 of the policy wordings here.

Q: What are the policy wordings for Fraud Protect360 Plus?

A: Please refer to the full Policy Wordings for Fraud Protect360 Plus here.

Q: Does the policy cover corporate cyber attacks?

A: No, it only covers personal/individual cyber events.

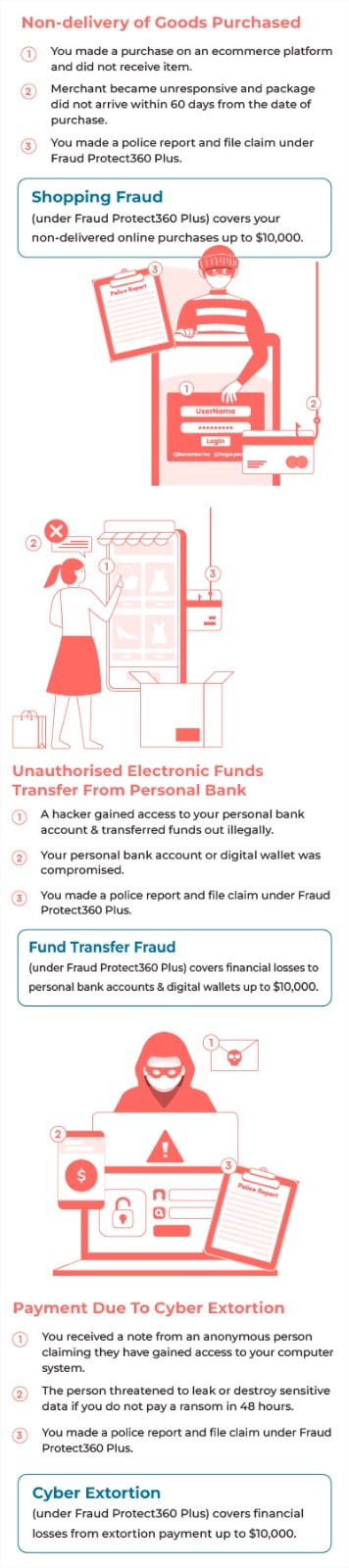

Q: What is covered under Online Shopping Fraud?

A: It covers situations where you purchased goods from an online merchant but the goods were not delivered and the merchant did not provide a refund or remedial action within 60 days

Q: What is covered under Fund Transfer Fraud?

A: It covers the following Fund Transfer Fraud events:

- The fraudulent electronic transfers of funds from Your Personal Account by a Third Party;

- Fraudulent transfer of funds or property from Your Personal Account to a Third Party after being defrauded, with the first e-communication being unsolicited and first sent to you via Email, SMS or WhatsApp

- The fraudulent unauthorised use of or electronic transfer of funds stored in Your personal Digital Wallet held by an Online Merchant

Q: What is covered under Cyber Extortion?

A: It covers extortion payments made to a third party due to cyber extortion threat, as well as fees for experts appointed to advise or respond to the threat.

Q: What is covered under Restoration Cost?

A: It covers the costs to investigate, repair damage, retrieve or replace digital assets, remove malware, and restore your computer system after unauthorised access, or malware infection by a third party.

Q: What is covered under Identity Theft?

A: It covers reasonable expenses and legal costs incurred to re-establish your reputation such as correcting or reinstating public records, dismissing or withdrawing civil or criminal records, enrolment and registration support for single credit monitoring or copying charges and registered mail postage for sending the required documentation and loan reapplication (if any) after an identity theft event involving online theft or misuse of your personal data by a third party to commit fraud.